Over the past few years, the take rate of air disc brakes (ADBs) has been steadily growing. This growth has only accelerated recently, thanks in part to the fact that many truck OEMs have made air disc brakes standard equipment. International, Kenworth and Peterbilt are among the manufacturers who now offer ADBs as standard on their Class 8 models, and Freightliner Trucks recently announced that they will offer ADBs as standard on the new Cascadia beginning this spring.

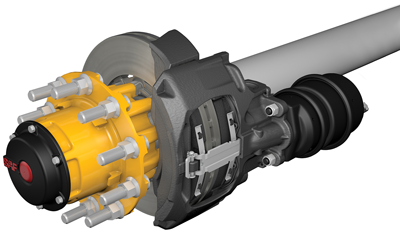

From an equipment spec’ing perspective, the difference between disc brakes and drum brakes is simple: Drum brakes cost less up front, but disc brakes provide better performance, including improved stopping distance, and a decreased need for maintenance. It seems that an increasing number of fleets are calculating that the trade-off is worth it, and OEMs are starting to do the same.

The brake manufacturers polled for this story pegged the take rate of air disc brakes at around 18% to 25% for heavy-duty tractors. For context, FE asked the same question for a 2015 story and the range at the time was 12% to 15%.

“We see this as a catalyst for change,” says Bill Hicks, manager of product planning for the Americas with SAF-Holland, “and it will facilitate future discussions and considerations for those fleets considering ADB on their new trailer orders.”

In fact, many of the brake companies in this story say they see air disc brake orders approaching or matching those of drum brakes within the next decade. T.J. Reed, Meritor’s vice president of front drivetrain for North America, says that Meritor sees the air disc brake market driving more than 40% of the overall brake market by 2025; while Walter Frankiewicz, president of Haldex Brake Products and senior vice president of Haldex AB, North American sales, sees the ADB market for tractors hitting 50% around 2020-2021.

ADB take rates are lower for trailers than for tractors, which has been true from the beginning. The brake manufacturers estimated that the number of trailers spec’d with ADBs is currently in the 12 to 15% range. However, the increased number of disc brakes on tractors is spurring more growth in the trailer market as well, especially from fleets spec’ing new trucks with ADBs as standard.

“Disc brake penetration was higher on tractors even before some of these OEMs made disc brakes the standard offering,” says Jeff Wittlinger, business unit director of wheel-end and braking systems for Hendrickson. “As a result [of OEMs making ADBs standard], we are seeing more fleets experiment with disc on trailers.”

“We are seeing more orders for disc brake trailers from fleets looking for a common platform across their fleet,” agrees Greg Cooper, product manager for disc brake systems with Stemco. “In fact, we expect about half of the trailer market to convert over the next 10 years.”

Frankiewicz says that in Haldex’s view, the trailer segment will shift priorities to ADB very quickly, hitting 50% market share sometime around 2022-2023.

The OEM perspective

International Trucks is one of the OEMs offering air disc brakes as standard—in this case on the Class 8 LT Series.

Jim Nachtman, International’s heavy-duty product marketing director, says that the OEM “recognizes the clear advantages of ADB,” calling out the shorter stopping distance, reduced CSA violations and longer life of the brake pads as reasons International put ADBs in the standard position on the LT Series.

Nachtman says that the reaction from fleets to having ADBs as standard equipment has been positive.

“With safety and cost of ownership of paramount importance, fleets are recognizing the benefits of air disc brakes,” he says. “We are seeing air disc brakes rapidly growing in popularity in the regional haul RH Series as well. Overall, we anticipate that the popularity of air disc brakes will continue to increase.”

Answering common questions

One reason ADBs may be headed for accelerated growth is because brake manufacturers have begun to address some of the concerns potential customers had with ADBs. Specifically, many fleets are turned off ADBs due to the weight, mechanical complexity and initial purchase price. With this in mind, many newer ADBs have focused on cutting weight and simplifying the design, which in turn is driving down the cost.

“Suppliers have made significant efforts to drive down disc brake package weights over the last several years,” Hendrickson’s Wittlinger says. “Last year, Hendrickson expanded its MAXX22T product line to include a lightweight wheel-end offering.”

“ADBs are becoming lighter and less complex in their operation—so the poor performance and complicated maintenance days for ADB in North America are behind us, as many suppliers are now finding out,” Haldex’s Frankiewicz says. “Our fleets jokingly say that if they wanted a Swiss watch, they would buy a Swiss watch.”

While air disc brake penetration is growing, don’t forget that this is still a relatively new technology. Drum brakes are still the majority, and many fleet managers have their fair share of questions about ADBs and how the brakes fit with their fleet. Keith McComsey, director of marketing and customer solutions (wheel-end) with Bendix Spicer Foundation Brake, shared the three most common questions Bendix gets from fleets about ADBs. Let’s take them one at a time.

1) Will we break even or lower our TCO if we spec ADB?

As you might expect, the answer to this question is always different, depending on the fleet and the application.

“If it was simple, every fleet would be spec’ing ADB,” McComsey notes. “But every fleet is unique in its combination of application, drivers, maintenance, trade cycles, ADB costs, CSA scores, safety record, etc.”

McComsey touts Bendix’s ADB Value Calculator, available online, which allows fleets to provide inputs (i.e., ADB up-charge, maintenance costs, labor rates, etc.) that generate a report that estimates their savings (or penalty) if they choose to spec ADBs over drum brakes.

The other suppliers echo the importance of application to answer this question.

“Fleets need to seriously look at their business model and evaluate the long-term potential benefits that ADB can bring to their overall fleet efficiency and safety performance,” SAF-Holland’s Hicks says.

“We still caution fleets to do their homework when it comes to ADBs,” Hendrickson’s Wittlinger says. “Air disc brakes are still relatively new in the North American trailer market, and many fleets have not seen a full trailer trade cycle. We recommend that fleets carefully consider all the factors when calculating payback. Variables like driving habits, brake duty cycle and operating conditions can have a significant effect on brake wear. Other factors such as compliance and stopping distance also come into play. Different fleets put different values on each one of these aspects.”

For those on the fence about ADBs, Meritor’s Reed suggests spec’ing disc brakes on the front axles and drum brakes on the rear. This way, Reed says, “fleets realize the benefits of an ADB but at a reduced system cost.”

2) Why would I spec ADBs when my fleet has a good driving record and does not see a significant number of accidents?

“I’m not here to tell you that if your fleet uses ADB that it will reduce the number of accidents, because nobody can predict how many accidents a fleet may see from year to year,” McComsey says. “But, because ADB reduces stopping distances when compared to drum brakes, ADB has the potential to reduce the risk of an accident and/or its severity. Having the potential to reduce the severity of an accident (i.e., from injury to property damage only) or turn an accident into a near miss is a good thing for fleets.”

3) My technicians have been maintaining drum brakes for years. How would I train them on ADB?

As McComsey points out, each brake manufacturer has plenty of resources available online for technicians with questions, and also offer online training. Each of the ADB suppliers FE interviewed touted the resources at the disposal of customers who are new to ADBs.

In fact, one of the key advantages of ADBs is that they require less maintenance than their drum brake counterparts.

“Because disc brakes are built with fewer components, maintenance is simpler and takes less time—which offers the additional advantage of increasing vehicle uptime,” Meritor’s Reed notes.

That reduced maintenance includes increased service intervals for brake friction. However, you shouldn’t assume that this means ADBs can also go without regular preventative maintenance; that remains crucial.

“While the perception may be that air disc brakes are maintenance-free, the reality is that, like any other braking system, a regularly planned maintenance schedule is integral to maximizing performance, enhancing safety and achieving optimal life,” Hendrickson’s Wittlinger says. “Performing regular inspections for integral ADB components like brake pads and calipers can significantly impact system life and performance.”

Avoiding disc brake CSA citations

Another key way to cut down on brake costs is to avoid Compliance, Safety, Accountability (CSA) citations. Brakes are the second-most penalized component of the truck, after lighting, and it can lead to unnecessary delays and downtime that fleets just can’t afford.

Innovative Products of America (IPA) touts its Alpha Mutt, a diagnostic trailer tester. Technicians can perform tests on many components of the trailer, including the air disc brakes, using IPA’s custom diagnostic software.

In terms of air disc brakes, features highlighted by the company include:

- Tablet or remote-controlled air brake activation;

- Real-time, repetitive brake activation to find developing problems and verify leaking servo cans; and

- The ability to perform analog leak-down tests in service and emergency lines.